News

For immediate release Global Ports Investments PLC Q4 and FY 2022 Operational results

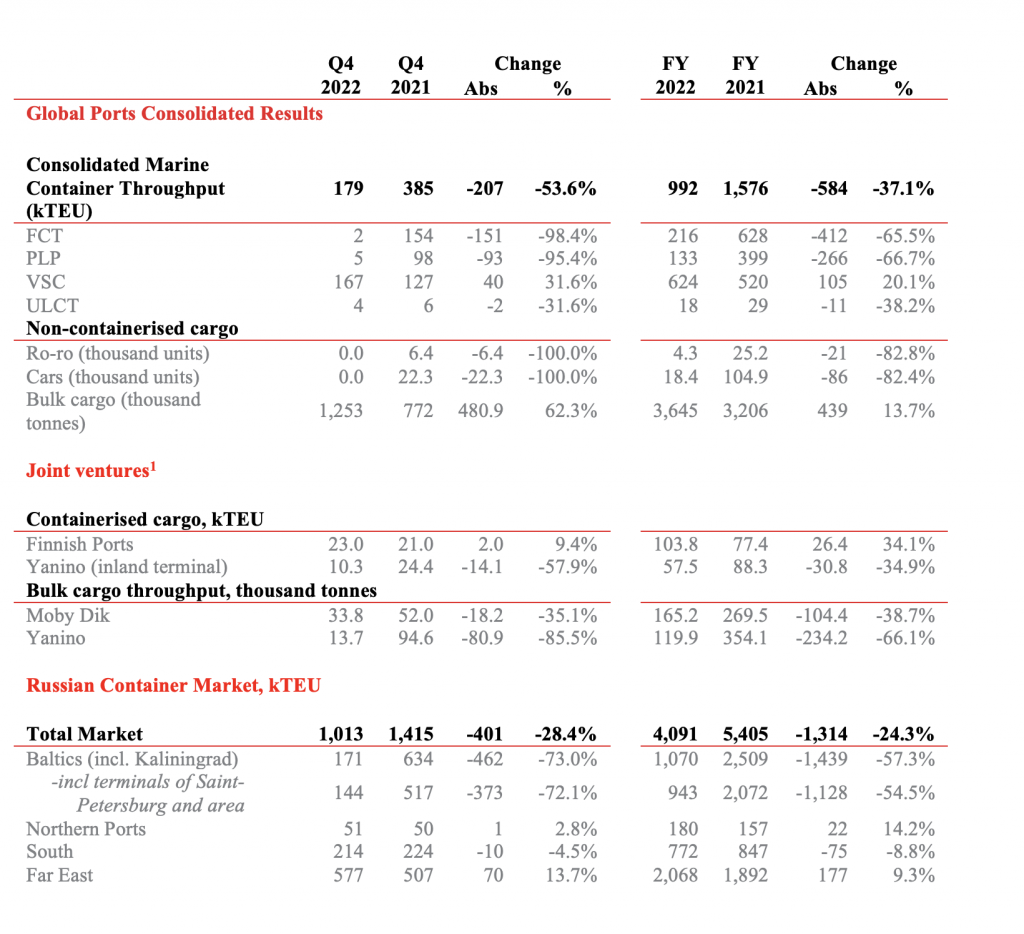

Global Ports Investments PLC ("Global Ports" or the "Company" and, together with its subsidiaries and joint ventures, the "Group") (LSE ticker: GLPR) today announces its operational results for Q4 2022 and FY 2022.On the back of significant reduction of vessel calls of key container shipping lines to the ports of Russia, both the Russian container market in the Baltic basin and the Group’s terminals located therein experienced severe decline in container, cars and Ro-Ro throughput in Q4 2022 and FY 2022. At the same time, container throughput in the Far Eastern basin and at VSC, the Group’s terminal in Far East, increased driven by a rebuilding of supply chains from European to Asian routes.

In 2022, the Group’s Consolidated Marine Container Throughput declined 37.1% y-o-y to 992 thousand TEU (Q4 22: 179 thousand TEU or a decline of 53.6% y-o-y) due to the reasons described above.

Container throughput at VSC increased in 2022 by 20.1% y-o-y to 624 thousand TEU (Q4 22: 167 thousand TEU or growth of 31.6% y-o-y) posting a record volume in terminal’s history driven by high demand in the region as well as Group’s effort to increase operational efficiency of the terminal and investments in its infrastructure and equipment.

The Group’s Consolidated Bulk Throughput increased by 13.7% y-o-y to 3.6 million tons in 2022 (Q4 22: 1.3 million tons or growth of 62.3% y-o-y) as results of the Group’s successful efforts to use available container capacity and terminals’ infrastructure to attract non-container business.

The market outlook for 2023 remains uncertain. Although we see our customers’ growing interest in container vessel calls in the Baltic basin, we do not see ground to expect market recovery to 2021 volumes in the region in 2023. The Far Eastern market is experiencing high demand which might exceed capacity of container terminals and the supporting infrastructure in the region driving the Group’s intention to continue further development of VSC. In the Baltic region the Group is focusing on the utilisation of its terminals with non-containerised cargoes as well as on cost management.

ENQUIRIES

|

Global Ports Investor Relations +7 (812) 677 15 57 +7 916 991 73 96 E-mail: ir@globalports.com |

Global Ports Media Relations +7 (812) 677 15 57 ext. 2889 +7 921 963 54 27 E-mail: media@globalports.com |

NOTES TO EDITORS

Global Ports Investments PLC is the leading operator of container terminals in the Russian market in terms of capacity and container throughput.[2]

Global Ports’ terminals are located in the Baltic and Far East Basins, key regions for foreign Russian trade and transit cargo flows. Global Ports operates five container terminals in Russia (Petrolesport, First Container Terminal, Ust-Luga Container Terminal[3] and Moby Dik in the Russian Baltics, and Vostochnaya Stevedoring Company in the Russian Far East) and two container terminals in Finland[4] (Multi-Link Terminals in Helsinki and Kotka). Global Ports also owns inland container terminal Yanino Logistics Park located in the vicinity of St. Petersburg.

Global Ports’ revenue for the first half of 2022 was USD 271.6 million and Adjusted EBITDA was USD 145.6 million. Consolidated Marine Container Throughput was 611 thousand TEUs in the first half of 2022.

Global Ports’ major shareholder is Delo Group, the largest intermodal container and port operator in Russia[5] (61.5%). 20.5% of Global Ports shares are traded in the form of global depositary receipts listed on the Main Market of the London Stock Exchange (LSE ticker: GLPR).

For more information please see: www.globalports.com

LEGAL DISCLAIMER

Some of the information in these materials may contain projections or other forward-looking statements regarding future events or the future financial performance of Global Ports. You can identify forward-looking statements by terms such as “expect”, “believe”, “anticipate”, “estimate”, “intend”, “will”, “could,” “may” or “might” or the negative of such terms or other similar expressions. Any forward-looking statement is based on information available to Global Ports as of the date of the statement and, other than in accordance with its legal or regulatory obligations, Global Ports does not intend or undertake to update or revise these statements to reflect events and circumstances occurring after the date hereof or to reflect the occurrence of unanticipated events. Forward-looking statements involve known and unknown risks and Global Ports wishes to caution you that these statements are only predictions and that actual events or results may differ materially from what is expressed or implied by these statements. Many factors could cause the actual results to differ materially from those contained in projections or forward-looking statements of Global Ports, including, among others, general political and economic conditions, the competitive environment, risks associated with operating in Russia and market change in the industries Global Ports operates in, as well as many other risks related to Global Ports and its operations. All written or oral forward-looking statements attributable to Global Ports are qualified by this caution.

[1] In December 2022, the Group consolidated 100% of Moby Dyk and Yanino terminals. See press-release dated 30 December 2022 https://www.globalports.com/en/investors/news/20221230/

[2] Company estimates based on FY 2022 throughput and the information published by the “ASOP”.

[3] In which Eurogate currently has a 20% effective ownership interest.

[4] Joint ventures in each of which CMA Terminals currently has a 50% effective ownership interest.

[5] According to publicly available data at www.delo-group.com.

< Back to list